Valuation Services & Analytics

BROKER VALUATIONS

Accurate, Timely, and Responsive Broker Valuations

One thing we learned from the economic landscape of the last decade is that collateral value can rapidly fluctuate based on local market conditions. To assess collateral risk while meeting mission-critical deadlines, lenders, servicers, and investors require accurate, timely, and responsive valuations from a local market source such as a realtor or broker. Our solutions include:

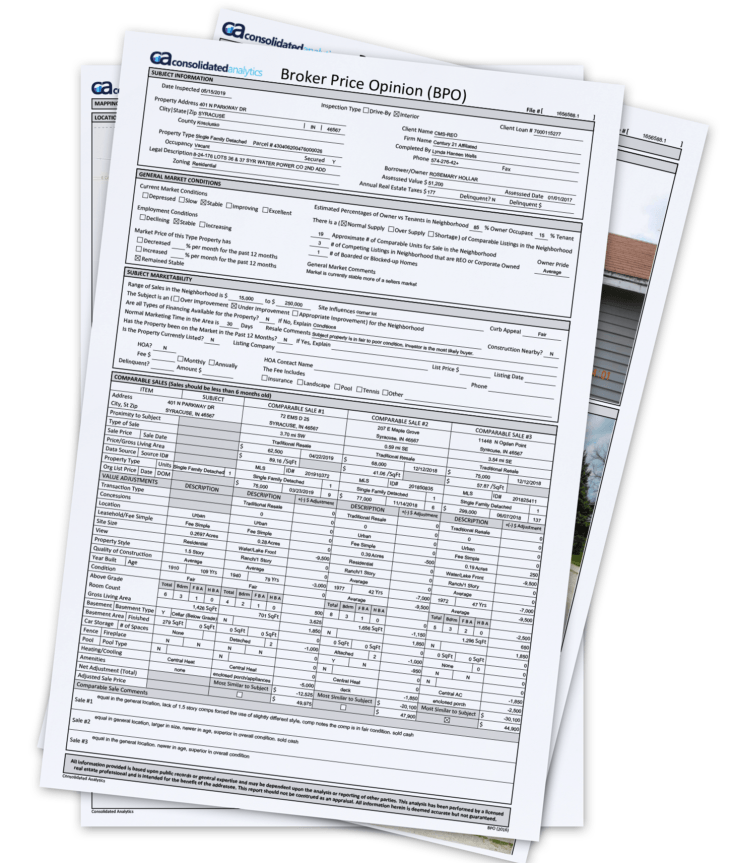

Our Interior and Exterior Broker Price Opinion (BPO) is provided by a local licensed real estate agent and provides an opinion of the residential real estate market price. Each broker valuation delivers a “30-day/ quick sale,” “as-is,” “repaired value,” and “suggested list price.” Our BPOs are available for both residential and commercial properties.

The solution includes:

- Interior and/or exterior property photos

- Subject property details

- Property description, condition assessment, and photos

- 3 listed and 3 sold comparable properties

- Map of subject property and comps

- Neighborhood data and value trends

Our Interior and Exterior Property Condition Report is a customizable condition report completed by a licensed real estate agent or broker. This product can be coupled with additional desktop products to develop customized solutions for client-specific applications. A standard interior and exterior condition report includes:

- Subject property and neighborhood assessment

- Subject and neighborhood maps

- Extensive Interior and/or exterior condition covering key property features such as structural damage, fire damage, water damage, electrical, and HVAC

- Interior and/or Exterior Condition Photos to support report findings

- Comments providing additional context on property condition

- A graded condition rating

Going Beyond BPO

Whether you are evaluating portfolio risk, racing the clock to meet agency guidelines, identifying quick sale values, or assessing your REO returns, Consolidated Analytics has the solutions to accomplish your valuation objectives. Our BPOs help mortgage lenders, servicers, and investors obtain quick, reliable, and accurate valuations by:

- Leveraging proven processes to streamline and accelerate BPO delivery

- Tapping into a vetted, scored, and scrubbed nationwide network of local, experienced brokers

- Providing responsive communications and fast resolution with elevated service

- Utilizing a multi-tier QC process that leverages both automated tools and hands-on expertise

- Offering appended reports, analytics, and customization to meet your specific goals

Check Out Consolidated Analytics’ Valuation and Review Suites

Quality Network

• Broker recruitment strategies center around quality, BPO performance, competence in valuing property, accessibility, timeliness, and local market knowledge

• Brokers in our nationwide network undergo comprehensive ongoing scoring to ensure quality

• Our broker network is regularly scrubbed to eliminate non-compliant brokers

Established Controls

• Automated QC identifies data errors and missing information to increase efficiency and accelerate timelines

• Review Analysts ensure BPO values are supported and check for completion, obtain an explanation of value, and provide an explanation of deviation, if necessary

• Consistent communication with brokers ensures swift corrective action, explanation and/or clarification of value, and delivery of supporting data

Responsive Service

• We provide timely delivery of residential and light commercial BPOs, property inspections, and value reconciliation reports

• To minimize turn times, we emphasize responsiveness to client and vendor requests

• We offer a range of timeline options to meet your needs, including 24-hour rush, 48-hour rush, 72-hour rush, and standard 5-day