What is the word on the street about the state of the mortgage market and what are lenders and servicers doing to prepare? Below is a short compilation of commentary from the Federal Reserve Bank and the MBA:

Federal Reserve Bank of New York:

The Federal Reserve Bank of New York article, “What’s Next for Forborne Borrowers,” provides a few interesting insights, including:

- Nearly two-thirds of forbearance participants left forbearance by March 2021.

- Although the average participant spent five months in forbearance, a third of participants were in forbearance for less than two months.

- According to the Financial Accounts of the United States: Since home equity is at an all-time high, many borrowers were able to sell their homes to get out of forbearance. *This opportunity was not available to homeowners during the 2008 crisis.

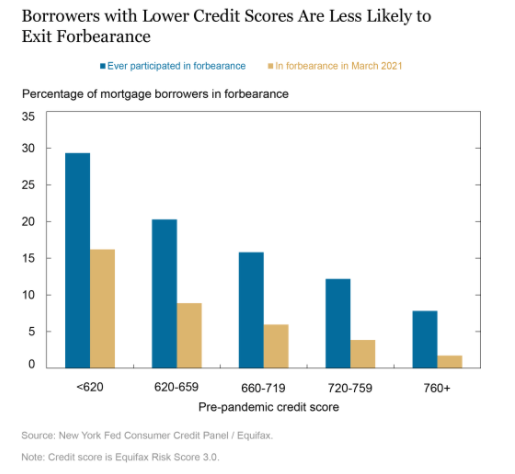

While more participants are exiting forbearance, trends related to low-income borrowers are more concerning. The article states:

- Lower-income borrowers that entered forbearance are lingering there.

- Almost 30 percent of lower credit score borrowers entered forbearance over the last year.

- More than half of the lower credit score borrowers remained in forbearance as of March 2021.

Summary: Overall, the outlook is positive compared to the 2008 mortgage crisis, but for those borrowers that linger in forbearance, a long and slow path to recovery is to be expected. The Federal Reserve Bank of New York provides context around the lower-income population, stating “a simple and conservative way of thinking about how the end of forbearance might play out from a risk perspective is to assume that those borrowers not making payments will be at severe risk of entering serious delinquency at the program’s conclusion. This amounts to about 2.9 percent of all mortgage borrowers, suggesting that the serious delinquency rate could rise to around 3.8 percent, up from 0.9 percent at present and well above the pre-pandemic rate of about 1.3 percent.”

Mortgage Bankers Association:

The MBA’s recent press release outlining its forbearance and call volume survey results shows:

- The number of loans in forbearance decreased by two basis points over the past week down to 4.16%.

- 2.1 million homeowners are in forbearance plans.

- A 14-week decline in the share of loans in forbearance.

- A slowing around forbearance exits.

Additionally, Mortgage Bankers Association’s National Delinquency Survey shows delinquencies on one to four units decreased to 6.38% of all outstanding loans at the end of 2021’s first quarter

Summary: Forbearance and delinquency trends are moving in the right direction and combined with a slow but steady economic recovery, these trends will hopefully continue along that trajectory. Mike Fratantoni, MBA’s Senior Vice President and Chief Economist said, “Although the headline employment growth number for May was lower than many had anticipated, other data show evidence of a strengthening job market. That is good news for homeowners who have been struggling and are looking for work, as more families can regain their incomes and start making their mortgage payments again.”

Consolidated Analytics conclusion:

Consolidated Analytics is monitoring the housing market and economy closely. The 2.1 million borrowers who are still in forbearance face the fast-arriving June 30th deadline. The economy is slowly recovering and jobs are returning, but there are so many other factors that are difficult to measure. What impact has the pandemic had on the workforce and the service industry? Will lower-income borrowers find their way out of forbearance? When the moratorium lifts, will the delinquency rates creep back up? How will individual lenders address foreclosures after the June 30th deadline?

As our clients move into a new phase of servicing, we anticipate that loss mitigation and loan modifications will remain a priority, and portfolio risk monitoring will be essential. Consolidated Analytics has a few key solutions that may be relevant for this next phase, including monthly property valuation analytics and flexible business process services/ default services. How can we help you? Reach out to our team to learn more by emailing sales@ca-usa.com

.